STATISTICAL STUDIES OF THE IMPACT OF INNOVATIONS, INVESTMENTS IN INNOVATIONS AND EXPORTS ON THE GRP OF THE KYZYLORDA REGION OF THE REPUBLIC OF KAZAKHSTAN

СТАТИСТИЧЕСКИЕ ИССЛЕДОВАНИЯ ВЛИЯНИЯ ИННОВАЦИЙ, ИНВЕСТИЦИЙ В ИННОВАЦИИ И ЭКСПОРТА НА ВРП КЫЗЫЛОРДИНСКОЙ ОБЛАСТИ РЕСПУБЛИКИ КАЗАХСТАН

Научная статья

Аралбаева Г.Г.1, *, Берикболова У.Д.2

1 ORCID: 0000-0001-7364-3128;

1, 2 Оренбургский государственный университет, Оренбург, Россия

* Корреспондирующий автор (galia55[at]mail.ru)

АннотацияВ статье представлены результаты исследования влияния инноваций, инвестиций, объемов экспорта на валовой региональный продукт (ВРП) Кызылординской области Республики Казахстан. Для общего исследования влияния инноваций на валовой региональный продукт был использован пакет Gretl, позволившая разработать эконометрическую модель, позволяющая отображать вклад рассматриваемых показателей в динамику ВРП и позволяющая осуществлять последующее его прогнозирование. Проверка качества модели осуществлялась на основе расширенного критерия Дики-Фуллера. Оценка модели показала, что в ВРП Кызылординской области значительный вклад оказывают инновации, при этом по силе влияния объем инновационной продукции превышает инвестиции в инновации. Проверка на адекватность спецификации проводилась с помощью теста Рамсея. Для проверки коинтегрированности был использован тест Йохансена.

Ключевые слова: инновации, экспорт, инвестиции, инвестиции в инновации, регион, валовой региональный продукт, эконометрическая модель.

STATISTICAL STUDIES OF THE IMPACT OF INNOVATIONS, INVESTMENTS IN INNOVATIONS AND EXPORTS ON THE GRP OF THE KYZYLORDA REGION OF THE REPUBLIC OF KAZAKHSTAN

Research article

Aralbaeva G.G.1, *, Berikbolova U.D.2

1 ORCID: 0000-0001-7364-3128;

1, 2 Orenburg State University, Orenburg, Russia

*Corresponding author (galia55[at]mail.ru)

AbstractThe article presents the results of the study of the impact of innovations, investments and export volumes on the gross regional product (GRP) of the Kyzylorda region of the Republic of Kazakhstan. It is emphasized that for the general study of the impact of innovations on the gross regional product the Gretl package was used. This enabled to develop an econometric model that helps to display the contribution of the considered indicators to the dynamics of GRP and raises the possibility of its subsequent forecasting. It is stressed in the article that the quality control of the model was carried out on the basis of the extended Dickey-Fuller criterion. The evaluation of the model showed that innovations make a significant contribution to the GRP of the Kyzylorda region while the volume of innovative products exceeds investments in innovations in terms of the power of influence. The article shows that the adequacy of the specification was checked using the Ramsey test. The Johansen test was used to check cointegration.

Keywords: innovation, export, investment, investment in innovation, region, gross regional product, econometric model.

Introduction

Economic development of the Republic of Kazakhstan mainly corresponds to the trends in the development of the world economy. At the same time the economic development of the republic depends on the economic development of its regions. The leading indicator characterizing the economic development of the regions is the gross regional product. GRP data of the Kyzylorda region of the Republic of Kazakhstan for the period from 2000 to the present is characterized by an unstable trend. Since 2014 there has been an annual decrease in GRP volumes in the region which is associated with a decrease in oil production due to the exhaustion of resources as well as a drop in uranium production. At the same time industrial production is being reoriented to other types of economic activity primarily related to innovation. In particular, the production of products based on ammonium metavanadate has begun. The transition of Kazakhstan's regions to non-primary production and export is important for the further development of the country's economy. This is possible only as a result of the transition of the Republic of Kazakhstan and its regions to a resource-innovative model of economic development. This strategy is based on the use of the potential of resource-producing industries, domestic science, innovations, new technologies and first of all assumes accelerated growth of processing industries. A number of scientists paid attention in their research to the importance of a strategy for the development of regions based on innovations. In particular, Baklanov A. O. presents a model of an innovative economy considered in interaction with its main factors and with the external environment which includes science, society, the state, education, business, the market and economic security [1]. Zagoruiko M. V., Kozenko Z. N. hold the view that a resource-innovation strategy is preferable. It is characterized by a multiplicative effect from the use of innovations for the modernization of domestic technologies and the restructuring of processing and manufacturing industries [2], [3].

MethodsThe Gretl package was used for general analysis in the present article. An econometric model has been developed in order to identify the impact of innovative development, investment in innovations, exports on the dynamics of the gross regional product of the Kyzylorda region. It allows displaying the contribution of innovative development indicators to the dynamics of GRP and enabling its forecasting. The quality control of the model was carried out on the basis of the extended Dickey-Fuller criterion. Verification of the adequacy of the specification was carried out using the Ramsey test which showed the correctness of the choice of the model shape. The Johansen test was used to check cointegration.

The purpose of the study is to identify how the indicators of investments in fixed assets, investments in innovations, production of innovative products and exports affected the dynamics of the GRP of the Kyzylorda region.

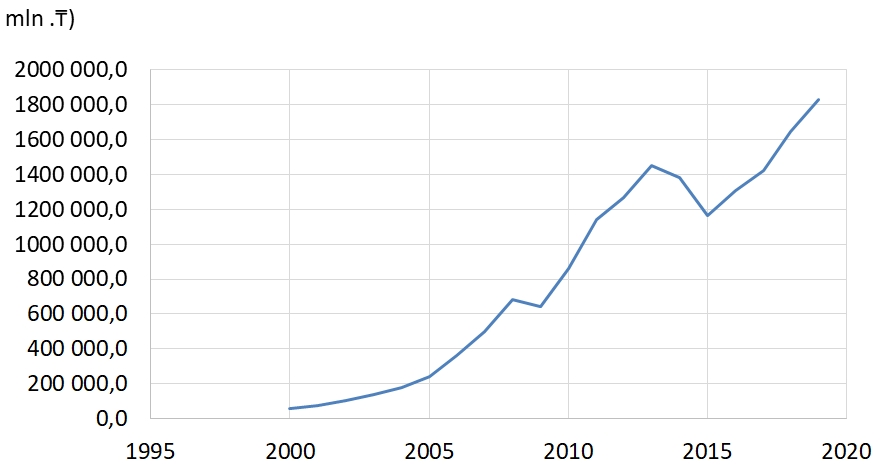

Main resultsThe dynamics of GRP and the share of investments in innovation and the production of innovative products should be considered to study the impact of innovative development on the dynamics of the gross regional product of the Kyzylorda region. The dynamics of the GRP of the region is presented in the figure below (see figure 1).

Fig. 1 – Dynamics of GRP of the Kyzylorda region of the Republic of Kazakhstan

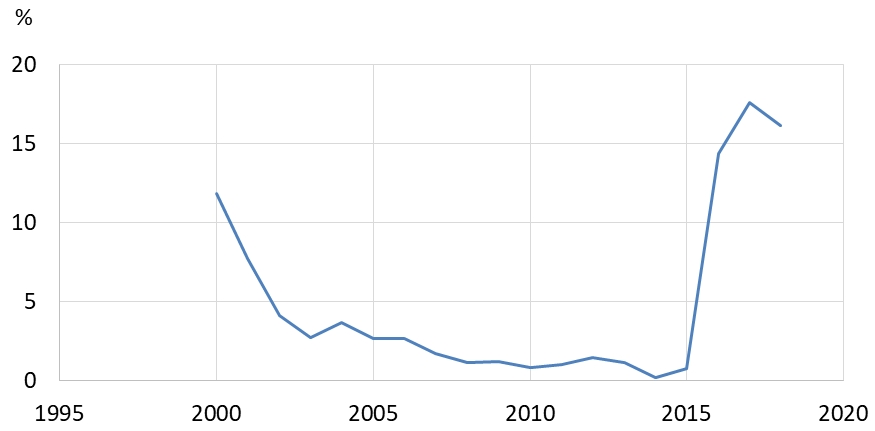

During the period under review there was an increase in the gross regional product of the Kyzylorda region with a significant decrease in 2015. The dynamics of investments as well as GRP has a positive trend but the share of investments in innovations is ambiguous. It is characterized by an unstable trend. The share of investment in innovation activities in the region is presented in the figure below (see figure 2).

Fig. 2 – The share of investments in innovative activity of the Kyzylorda region

It was previously established that the time-series of the considered indicators are integrated of the first order. These indicators include export, investments in fixed assets, investments in innovations and the production of innovative products that affected the dynamics of the GRP of the Kyzylorda region. The verification was carried out on the basis of the extended Dickey-Fuller criterion, the ADF-GLS test, and the KPSS test [4]. According to the Dickey-Fuller criteria and the ADF-GLS test, the null hypothesis of first-order integration is not rejected. According to the KPSS test, the null hypothesis of zero-order integration is rejected in favor of an alternative hypothesis of first-order integration. Therefore, all the considered time-series are series with a stochastic trend. In order to identify the impact of innovative development on the dynamics of the gross regional product of the Kyzylorda region, an econometric model has been developed. This model allows displaying the contribution of innovative development indicators to the dynamics of GRP and enables its forecasting. The general model is presented in the form of the formula (1):

where VRPKOt, Expt – the GRP and export volume of the Kyzylorda region, respectively at the time t, t=2,..., 20;

InvinnovKOt, InnovprodKOt – the volume of investments in innovations and the volume of innovative products of the Kyzylorda region, respectively, at time t, t=2,..., 20;

InvinnovKOt-1, InvKOt-1 – an investment in innovation and investment in fixed assets in the Kyzylorda region at time t-1, t=1,..., 19;

![]() - parameters to be determined;

- parameters to be determined;

![]() - white noise (a stationary random (non-autocorrelated) process distributed according to a normal law with zero mathematical expectation and constant variance).

- white noise (a stationary random (non-autocorrelated) process distributed according to a normal law with zero mathematical expectation and constant variance).

The Johansen test was used to check cointegration [6]. The parameters of the obtained model were estimated using the maximum-likelihood method. The evaluation results are presented in table below (see table 1).

Table 1 – Results of evaluation of the GRP forecasting model of the Kyzylorda region

| Parameter name | Parameter estimation | Standardized parameter estimation | Standard deviation | p-value (significance) |

| Expt | 70,1389 | 0,1816 | 16,57 | 0,0008 (signf.) |

| InvinnovKOt | 6,1594 | 0,1043 | 2,09 | 0,0108 (signf.) |

| InvinnovKOt-1 | 8,3720 | 0,1412 | 2,25 | 0,0024 (signf.) |

| InvKOt-1 | 2,9096 | 0,5565 | 0,42 | 0,0000 (signf.) |

| InnovprodKOt | 42,3515 | 0,1601 | 17,05 | 0,0263 (signf.) |

Verification of the adequacy of the specification was carried out using the Ramsey test which showed the correctness of the choice of the model shape. The analysis of the absence of autocorrelation based on the LM test showed that the null hypothesis is not rejected with a probability of 0.33. The estimation of the determination coefficient was 0.97 which indicates the high quality of the model. The resulting model is adequate to the sample data.

Table 1 presents the usual regression coefficients and standardized values that allow determining which of the factors had the greatest impact on the GRP of the Kyzylorda region. According to the obtained results the volume of investments in fixed assets in the region carried out in previous periods has the greatest impact on the GRP of the Kyzylorda region. In particular, an increase in investments in fixed assets in the Kyzylorda region by 1 million tenge this year leads to an increase in GRP by an average of 2.9096 million tenge in the following year.

The next factor in terms of the strength of influence on the GRP of the Kyzylorda region among the considered ones is the export of the region in the current period. According to the model the growth of exports by 1 million rubles stimulates the growth of GRP by an average of 70, 1389 million tenge.

The evaluation of the model showed that innovations make a significant contribution to the GRP of the Kyzylorda region while the volume of innovative products exceeds investments in innovations in terms of influence. It can be explained by the fact that innovative products are the final result of investments in innovations carried out over a long period of time. The study showes that investments in innovations in the previous period have a stronger impact on the GRP of the region than investments in innovations in the current period. Thus with an increase in investment in innovations in the previous period by 1 million tenge the GRP of the Kyzylorda region increases by an average of 8,372 million tenge, and an increase in investment in innovations in the current period leads to an increase in GRP by an average of 6,1594 million tenge.

Thus, according to the model, one tenge invested in investments in innovations has a great impact on the increase in the GRP of the region, in particular, an excess of more than 2.8 times. (8,37 / 2,9 = 2,8).

It was also identified that there is a co-integration relationship between exports and investment in innovations; that is the series of dynamics of these indicators are in long-term equilibrium. The nature of the relationship between these indicators implies the presence of a two-way causal relationship when changes in investment in innovations in past periods lead to changes in the dynamics of exports and, conversely, changes in the dynamics of exports in past periods lead to changes in investment in innovations in the current period. In particular, the decline in the volume of raw materials exports and the state's course on the export of deep-processed products as well as competitive circumstances in the foreign market stimulate the development of high-tech domestic industries and the demand for innovative products.

The Granger causality test is used to test the hypothesis of bilateral causal dependence [7]. Both models are significant, therefore, the assumption of the presence of a two-way dependence is confirmed.

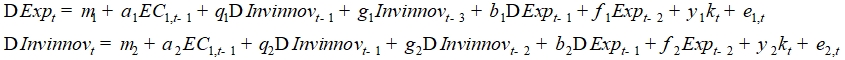

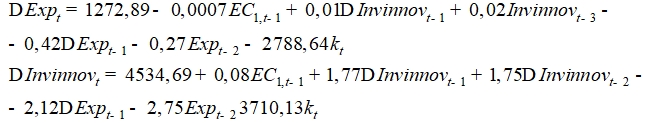

In such situation (co-integration and the presence of Granger causality) a vector model of error correction should be evaluated. It allows taking into account both short-term and long-term equilibrium [8], [9], [10]. The general view of the VECM model is presented in the form of the formula (2):

(2)

(2)

where ![]() - the first differences between exports and investments in innovations of the Kyzylorda region;

- the first differences between exports and investments in innovations of the Kyzylorda region;

![]() - free parameters of models;

- free parameters of models;

![]() - the amount of deviation from the long-term equilibrium;

- the amount of deviation from the long-term equilibrium;

![]() - parameters of short-term factors;

- parameters of short-term factors;

![]() - parameters for a binary variable.

- parameters for a binary variable.

The estimation of the coefficient of determination of the first model was 0.73 and the second model was 0.8 which indicates a high degree of model quality. The evaluation of the VECM model has the form (3):

(3)

(3)

The estimates of the parameters of the model (3) are not amenable to meaningful interpretation. The interpretation of VECM models is based on impulse responses which show how an exogenous shock in one standard deviation spreads over time. In particular, it is of interest how a shock in investment in innovations affects the volatility of exports as well as how a single shock in exports affects the fluctuation of investment in innovations.

According to the obtained results, the following conclusions can be drawn:

- a single shock in the export of the Kyzylorda region leads to a response of 167 standard deviations in the second year, 321 standard deviations in the third year followed by a decrease to 47 by the fifth year after a single shock;

- a single shock in investment in innovation leads to the greatest response in the third year after the shock (4118 standard deviations).

Conclusion

1) Positive impact of export expansion on the GRP of the region is proved on the basis of the developed mathematical model. Against the background of a decline in commodity exports the importance of innovative products in GRP has increased. The developed model of the dependence of the GRP of the region on export indicators and investment in innovations enabled to establish an almost threefold excess of the return on investment in innovations compared to investment in fixed assets;

2) it is mathematically proved that sharp fluctuations in export volumes in recent years (a decrease in export volumes) lead to a significant increase in investment in innovations in the second and third year after the decline in exports. Respectively, sharp spikes in investment and innovation are reflected in the exports of the Kyzylorda region.

| Конфликт интересов Не указан. | Conflict of Interest None declared. |

Список литературы / References

- Бакланов А. О. Анализ и оценка перспектив перехода к инновационной экономике на основе «дорожной карты» / А.О. Бакланов, В.С. Романцов, Н.И. Комков // Мир (модернизация, инновации, развитие). – 2011. - № 5. – С. 49-55.

- Загоруйко М. В. Стратегия выбора бизнес-модели организации и методика оценки степени интернационализации компании / М.В. Загоруйко // Научное обозрение. – 2015. - № 15. – С. 419 – 423.

- Козенко З. Н. Концепт-стратегия внедрения инновационной модели хозяйствования в перерабатывающей сфере агропромышленного комплекса / З.Н. Козенко // Научное обозрение: теория и практика. – 2016. - № 2. –С. 40-50.

- Итоги социально-экономического развития Кызылординской области в 2020 году / Сетевое издание «Кызылординский вести». 2020. [Электронный ресурс], URL: https://kzvesti.kz/kv/frontpage/45070-itogi-socialno-ekonomicheskogo-razvitiya-kyzylordinskoy-oblasti-v-2019-godu.html. (дата обращения: 12.06.2021)

- Половников Д. С. Фундаментальные исследования / Д.С. Половников, И.Ю. Колпаков. - 2020. -№7. - С. 90-95.

- Семенова В. П. Применение программного продукта GRETL в статистических исследованиях / В.П. Семенова В.П. // Синергия Наук. - 2016. -№2. - С. 56-77.

- Бродский Б. Е. Структурные сдвиги и единичные корни: различение моделей нестационарности временных рядов / Б.Е. Бродский // Прикладная эконометрика. - 2008. -№3(11). - С. 52-63.

- Рейтинг конкурентоспособности регионов Казахстана. 2019. [Электронный ресурс], URL: https://forbes.kz/ranking/object/547 (дата обращения: 12.06.2021)

- Трегуб И. В. Применение коинтеграционного анализа для исследования взаимного влияния финансовых временных рядов / И.В.Трегуб, А.В.Трегуб //Фундаментальные исследования. - 2015. -№8-3. - С. 620-623.

- Смирнов Д. А.Эффект редкой выборки при оценке направленных связей по временным рядам / Д.А. Смирнов, Б.П. Безручко // Известия высших учебных заведений. Прикладная нелинейная динамика. - 2013. - Т. 21. - №2. - С. 61-73.

Список литературы на английском языке / References in English

- Baklanov A. O. Analiz i otsenka perpektiv perekhoda k innovatsionnoi ekonomike na osnove «dorozhnoi karty» [Analysis and assessment of prospects for the transition to an innovative economy based on the «road map»] / A. O. Baklanov, V. S. Romantsov, N. I. Komkov // Mir (modernizatsiya, innovatsii, razvitiye). [World (modernization, innovation, development)] – 2011. - № 5. – P. 49-55. [in Russian]

- Zagoruiko M. V. Strategiya vybora biznes-modeli organizatsii i metodika otsenki stepeni internatsionalizatsii kompanii [The strategy of choosing the business model of the organization and the methodology for assessing the degree of internationalization of the company] / M.V. Zagoruiko // Nauchnoye obozreniye. [Scientific Review]. – 2015. - № 15. – 419 – 423. [in Russian]

- Kozenko Z. N. Kontsept-strategiya vnedreniya innovatsionnoi modeli hozhyistvovaniya v pererabatyvayuschei sfere agropromyshlennogo kompleksa [Concept-strategy for the introduction of an innovative management model in the processing sphere of the agro-industrial complex]/ Z. N. Kozenko // Nauchnoye obozreniye: teoriya i praktika [Scientific review: theory and practice] . – 2016. - № 2. – P. 40-50. [in Russian]

- Itogi sotsialno-ekonomicheskogo razvitiya Kyzylordinskoi oblasti v 2020 godu [The results of the socio-economic development of the Kyzylorda region in 2020] / Setevoye izdaniye «Kyzylordinskiye vesti» [Online publication «Kyzylorda news»]. [Electronic resource], 2020. URL: https://kzvesti.kz/kv/frontpage/45070-itogi-socialno-ekonomicheskogo-razvitiya-kyzylordinskoy-oblasti-v-2019-godu.html. (accessed: 12.06.2021) [in Russian]

- Polovnikov D. S. Fundamentalniye issledovaniya [Fundamental research] / D. S. Polovnikov, I. Yu. Kolpakov. - 2020. -№ 7. - P. 90-95. [in Russian]

- Semenova V. P. Primeneniye programmnogo produkta GRETL v statisticheskikh issledovaniyakh [Application of the GRETL software product in statistical research] / V. P. Semenova // Sinergiya Nauk [Synergy of Sciences] . - 2016. -№ 2. - 56-77. [in Russian]

- Brodskyi B. E. Strukturnyie sdvigi i edinichnyie korni: razlicheniye modelei nestatsionarnosti vremennykh ryadov [Structural shifts and unit roots: distinguishing time series nonstationarity models] / B. E. Brodskyi // Prikladnaya ekonometrika [Applied econometrics] . - 2008. -№ 3 (11). - P. 52-63. [in Russian]

- Reiting konkurentosposobnosti regionov Kazakhstana [Rating of competitiveness of the regions of Kazakhstan] [Electronic resource], 2019. URL: https://forbes.kz/ranking/object/547 (accessed: 12.06.2021) [in Russian]

- Tregub I. V. Primeneniye kointegratsionnogo analiza dlya issledovaniya vzaimnogo vliyaniya finansovykh vremennykh ryadov [Application of cointegration analysis for the study of the mutual influence of financial time series] / I. V. Tregub, V. Tregub // Fundamentalnyie issledovaniya [Fundamental research] . - 2015. -№ 8-3. - P. 620-623. [in Russian]

- Smirnov D. A. Effekt redkoi vyborki pri otsenke napravlennykh svyazei po vremennym ryadam [The effect of a rare sample for evaluating directional relationships over time series] / D. A. Smirnov, B. P. Bezruchko // Izvestiya vysshykh uchebnykh zavedenyi. Prikladnaya nelineinaya dinamika. [News of higher educational institutions. Applied nonlinear dynamics] - 2013. - Vol. 21. - № 2. - P. 61-73. [in Russian]