CHARACTERISTICS OF FINANCIAL STABILITY EVALUATION OF THE AGRICULTURAL ORGANIZATIONS UNDER THE TRADITIONAL ANALYSIS OF FINANCIAL CONDITION

Секачева В.М.1, Скарюпина М.Б.2, Полинкевич А.Б3

1ORCID: 0000-0001-9300-2037, Кандидат экономических наук, доцент, Кемеровский государственный сельскохозяйственный институт, 2ORCID: 0000-0003-2933-9326, Старший преподаватель, Кемеровский государственный сельскохозяйственный институт, 3ORCID:0000-0002-6120-9217, Магистрант, Кемеровский государственный университет

ОСОБЕННОСТИ ОЦЕНКИ ФИНАНСОВОЙ УСТОЙЧИВОСТИ СЕЛЬСКОХОЗЯЙСТВЕННЫХ ОРГАНИЗАЦИЙ В РАМКАХ ТРАДИЦИОННОГО АНАЛИЗА ФИНАНСОВОГО СОСТОЯНИЯ

Аннотация

В статье рассматривается содержание понятия финансовой устойчивости организации, определен методический подход к оценке финансовой устойчивости, учитывая специфику сельскохозяйственного производства организаций. Для наиболее эффективной оценки финансовой устойчивости сельскохозяйственных организаций наряду с использованием предложенной интегральной оценки финансовой устойчивости, также рекомендуется проводить в ходе исследования факторный анализ коэффициентов финансовый независимости, финансовой зависимости и финансового риска, который строится на соотношении финансовых и нефинансовых активов.

Ключевые слова: оценка, финансовая устойчивость, интегральный показатель, факторный анализ.

Sekacheva V.M.1, Skaryupina M.B.2, Polinkevich A.B.3

1ORCID: 0000-0001-9300-2037, PhD in Economics, Kemerovo State Agricultural Institute, 2ORCID: 0000-0003-2933-9326, Senior Lector, Kemerovo State Agricultural Institute, 3ORCID:0000-0002-6120-9217, Master's Degree Student, Kemerovo State University

CHARACTERISTICS OF FINANCIAL STABILITY EVALUATION OF THE AGRICULTURAL ORGANIZATIONS UNDER THE TRADITIONAL ANALYSIS OF FINANCIAL CONDITION

The article discusses the concept content of financial soundness of organization. The author suggests methodological approach to the assessment of financial stability given specificity of agricultural organizations. The author also recommends for the most effective evaluation of the financial stability of the agricultural organizations during research along with the use of the proposed integrated assessment of financial stability to carry out factor analysis of financial independence ratio, financial leverage and financial risk which is based on the ratio of financial and non-financial assets.

Keywords: estimation, financial stability, integral index, factor analysis.

Nowadays the country's food security is an important and priority direction for the economic development in conditions of financial instability. It must rely on the state's sovereignty, economic and social sustainability. Today agro-industry politics is aimed at enhancement the efficiency and competitiveness of this economic sector, improvement of product quality and increasing to ensure the state reliability of the agricultural production.

Analysis of financial soundness plays an important role in solving these problems.

Solvency analysis technique is needed to determine the stability of the organization, its financial independence and investment attractiveness.

The methodical approach to the definition of financial soundness is diverse in the modern economic literature. There are different views on a set of indicators to define it. These circumstances have caused a certain scientific interest in the study of this problem. In particular, many aspects of this problem are presented in the work of scientists Y. Anisimova, A. Bulatov, I. Blanca, S. Chuprov, B. Gerasimov, M. Scar, I.Omelchenko, P. Okladsky, G. Savitskaya and others [2].

The calculation of absolute and relative indicators is mainly used during the solvency analysis of the organization. We shall consider the steps of calculating of criterions of supportability of reserve and costs source of funds for their formation (according to the balance sheet):

Step1. Calculation of the total amount of reserves and costs (RS):

RS= line code 1210+line code 1220, (1)

Step2. Calculation of indicators the availability of formation sources of reserves and costs:

а) Existence of working capital (WC), which is calculated as the difference between the sum of capital base sources and the sum of the fixed assets and investments:

WC= line code 1300+ line code 1530 - line code 1100, (2)

- b) Existence of own and long-term outside formation sources of reserves and costs (permanent capital):

OLO= line code 1300+ line code 1530+ line code 1400- line code 1100, (3)

- c) The total value of the main formation sources of reserves and costs (TS):

TS = OLO= line code 1300+ line code 1530+ line code 1400+ line code 1510- line code 1100, (4)

Step3. Three indicators of supportability of reserve and costs sources of their formation should be calculated based on three criterions of the availability of formation sources of reserves and costs:

- a) surpluses and shortages of working :

±Fws=WS- RS, (5)

- b) surpluses and shortages of fixed capital as formation sources of reserves and costs:

±F olo = OLO - RS, (6)

- c) surpluses and shortages of the total value of the main formation sources of reserves and costs :

±Fts= TS - RS. (7)

Step4. Three-component model of the type of financial condition is determined using criterion of supportability of reserve and costs sources of their formation:

S(F)={1, when F≥0, (8)

S(F)={0, when F<0. (9)

The following types of financial soundness are recognized depending on the degree of supportability of reserve and cost financing sources [4, p.116]:

- a) the absolute financial stability is determined by the excess of working capital sources to form reserves and costs (extremely rare):

S(F)=(1,1,1) , (10)

- b) the normal financial capability in which reserves and costs are provided by the working capital sum that are guarantees financial solvency:

S(F)=(0,1,1), (11)

- c) the unstable financial condition combined with the violation of solvency, but the organization still may be possible to restore the financial balance using replenishing sources of capital base, reducing accounts receivable, speed up the turnover:

S(F)=(0,0,1), (12)

- d) the financial crisis is determined by the fact that the reserves and costs are not provided with formation sources This situation suggests that cash, investments and receivables do not even cover The organization is in the process of bankruptcy:

S(F)=(0,0,0). (13)

Father, we consider the most common method of calculating the relative financial soundness indicators (indicators characterizing the debt-equity ratio). The calculation is based on the balance sheet:

- Equity ratio (equity to total assets ratio) characterizes the share of equity capital in the total amount of funds invested in the organization:

The recommended value is considered the level indicator ≥ 0.5 that characterizes organization as a financially independent, stable and steady from extra input.

- Ratio of debt capital characterizes leverage ratio in the grow sum of balance sheet total.

The optimal value is <0.5.

- Financial stability index (equity plus long-term debt to total assets ratio) characterizes constant component of capital in the total amount of funding sources:

The normal value of this industry is at least 0.75.

- Ratio of equity capital sources characterizes the presence of working capital needed to ensure the financial stability of the organization:

The average value is no less than 0.1.

- Current assets to equity ratio indicates the degree of mobility and flexibility in the use of equity and shows which part of the sources of equity used to finance current operations and which part is capitalized:

The optimal value is 0.05 or more.

- Ratio of borrowed and own funds (capital leverage) :

The recommended level is <0.7.

- Net fixed assets index. This indicator defines the share capital assets (fixed assets) in equity capital:

The specifics of this production sphere cannot be ignored by assessing these indicators in the agricultural organizations, namely:

- Natural and climatic conditions have a direct impact on the operating results of agro-industrial companies. Different natural phenomena such as drought, frost, rain can directly affect the productivity and other indicators. So it is advisable to compare with the aim ofcorrect calculate results analysis figures not with the previous period but with average indexes for the previous 3-5 years.

- The specific feature of agricultural production is a seasonal production so facility, subjects of labor and labor is not used uniformly during the analyzed period, the products are sold erratically. This characteristic should be considered in the analysis of resource efficiency in the organization.

- The peculiarity of agricultural production is also working with living organisms. Therefore, the organization should take into account not only economic factors but also biological, chemical and physical regularities as a result of factor analysis of organizations.

- Some agricultural products used for its own reproduction as seeds, fodder, etc. So sales volume to total production will be much less in such organization than in other industries.

- The specificity of agricultural organizations is the production of the same type products as opposed to industrial organizations. So the interfarm comparative analysis can be applied to the analysis of such organizations using methods of comparing time series, clustering method, correlation analysis, multivariate comparative analysis and others.

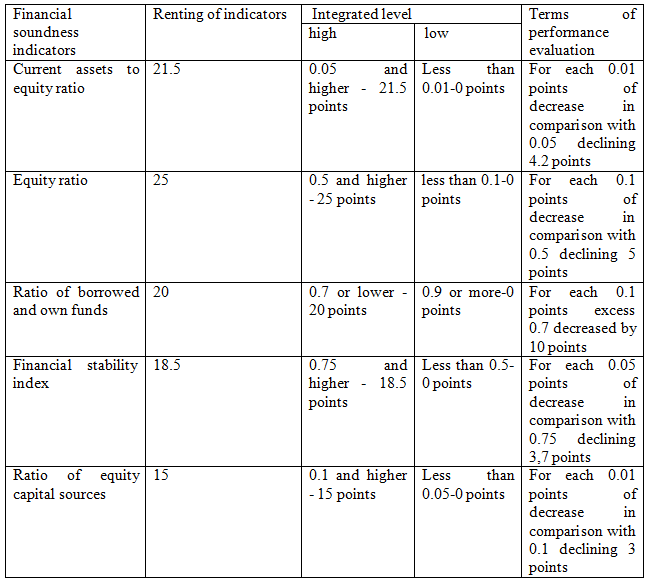

Paying attention on the basic features of the agricultural organizations we considered appropriate to offer along with the analysis of absolute and relative financial stability indicators, using calculation of integral index, which characterizes the financial soundness based on a point assessment (Table 1).

Table1- Integrated level of indicator values characterizing the financial stability of organization

The general type of financial stability of the agricultural organization is determined depending on the integral values and ranked by grade:

Grade 1 (81-100 points) - an organization of absolute stability;

Grade 2 (55-80 points) - an organization of normal stability;

Grade 3 (35-54 points) - an organization with satisfactory financial soundness;

Grade 4 (15-34 points) - an organization with unstable financial condition;

Grade 5 (0-14 points) - the organization is recognized as insolvent, bankrupt.

The algorithm method of calculating the integral index was taken as the basis for the proposed methodology from V. Artemenko and V. Ostapova’s textbook. It characterizes the solvency and financial soundness [1, p.245].

It is necessary to carry out factor analysis of equity to total assets, leverage ratio, financial risk index for the most effective evaluation of the financial soundness of the agricultural organizations along with the use of integrated assessment. Factor analysis is based on the ratio of financial and non-financial assets.

- Savitskaya offers the basis of this concept and represents following the model of factor analysis [3, p. 470]:

The factor model of financial independence:

where EC- equity capital (line code1300 + line code 1530 a form of "Balance sheet"),

NA- non-financial assets (line code 1100+ line code 1210+ line code 1220- line code 1170 a form of "Balance sheet"),

FA- financial assets (line code 1170+ line code 1230 + line code 1250 + line code 1260 + line code 1240 a form of "Balance sheet"),

BC- borrowed capital (line code1400 + line code 1500 a form of "Balance sheet"),

EB - exchange balance (line code 1600 a form of "Balance sheet").

The factor model of financial dependence:

where WNA - working non-financial assets (line code1210 + line code 1220 a form of "Balance sheet").

The factor model of ratio of borrowed and own funds (capital leverage) :

It is possible to determine how financial balance and sustainability of the organization is achieved based on these models. So organization is considered financially independent if the non-financial assets are covered by equity and financial assets - borrowed capital. At the same time stock of financial strength increases with the equity capital growth of non-financial assets as well as excess of financial assets over borrowed capital. The opposite situation would indicate a loss of financial stability, namely the excess of financial assets over equity capital.

As a result of the study it can be concluded there is no single concept the financial stability analysis given specificity of agricultural organizations at the present moment. The approaches, offered to a comprehensive assessment of the financial soundness of the agricultural organizations in this article, will allow to define financial stability of the organization provided with a high of shares equity in the total amount of used funds. The proposed approach will also allow to determine availability of the organization based on profit markup and as result increase of equity capital saving solvency in the modern economic conditions.

References

- Artemenko V.G., Ostapova V.V. Analysis of Financial Statements // Moscow: Omega-L. - 2008.-272p. [In Russian]

- Kolmogorova V.V., Skaryupina M. B. The concept of "economic stability": the interpretation. Retrieved on December 3, 2015 from http://elibrary.ru/download/40809457.pdf [In Ukraine]

- Savitskaya G.V. Analysis of economic activities of an organization // Moscow : New edition. -2006.-652p. [In Russian]

- Fateykina, N.V. Demchuk I.N. The development of methodical instruments of financial analysis, assessment of financial soundness, investment attractiveness of companies and its application in practical activities of commercial banks // SAFBM, Novosibirsk. - 2014. -500p. [In Russian]