АНАЛИЗ И ОЦЕНКА КРЕДИТНЫХ РИСКОВ БАНКОВСКОЙ СИСТЕМЫ КАЗАХСТАНА

Ергалиева М.Е.

Магистрант 2-курса Финансового факультета Казахского Экономического Университета имени Турара Рыскулова (г. Алматы)

АНАЛИЗ И ОЦЕНКА КРЕДИТНЫХ РИСКОВ БАНКОВСКОЙ СИСТЕМЫ КАЗАХСТАНА

Аннотация

В статье анализируются теоретические и практические проблемы реформирования экономики и банковской системы в целом. Цель статьи заключается в изучении теоретических и методологических подходов, теоретических и практических разработок для эффективного управления кредитными рисками банков в рынке РК. Статья написана на основе банковской деятельности в Казахстане в последнее десятилетие, переживающее период бурных изменений, что привело, с одной стороны, к радикальной трансформации экономической системы, с другой - к внедрению новых информационных технологий и глобализации финансовых рынков.

Ключевые слова: рентабельность собственного капитала, рентабельность активов, валовый внутренний продукт, портфолио, кредит, кредитное плечо, кредитный риск.

Yergaliyeva M.Y.

2nd year master’s degree student, Finance, Kazakh Economic University named after Turar Ryskulov, Almaty, Kazakhstan

ANALYSIS AND ASSESSMENT OF CREDIT RISKS OF THE BANKING SYSTEM OF KAZAKHSTAN

Abstract

The article analyses the theoretical and practical problems of reforming the economy and the bank system as a whole. The purpose of article is to explore theoretical and methodological approaches, theoretical and practical developments for the efficient management of credit risks of banks in a market of RK. The article is written on the basis of bank activity in Kazakhstan in the last decade, experiencing a period of turbulent change, which caused the one hand, the radical transformation of the economic system, on the other - the introduction of new information technologies and globalization of financial markets.

Keywords: return on equity, return on assets, gross domestic products, portfolio, loan, leverage, credit risk.

Action by the National Bank of RK (hence - NBRK) and the Committee of Financial Supervising (hence - CFS) to stabilize the banking sector continue to have a positive impact on the banking sector and contribute to:

- Increase confidence in banks by the public and, consequently, an increase in bank deposits;

- Stabilize exchange rate of tenge is as result of free-floating exchange rate of tenge. In case of a significant foreign exchange, inflows on the domestic market of National Bank will not allow strengthening of tenge in size, significantly reducing the competitiveness of exporters. National Bank’s monetary policy aimed at preventing speculative fluctuations in the tenge exchange rate;

- A significant increase in the risk control of the capital adequacy, liquidity, the value of foreign exchange position, the quality of loan portfolio, resulting in the banking sector gradually "cleansed" from unstable, unreliable banks, due to the development of prudential standards and different methods of regulating the control of risks and also planned introduction of IAS accounting.

Developments in the financial sector are primarily in the banking sector, characterized by widely differing trends. During the post-crisis period, there was further expansion of banking activities, growth rates were significant assets and liabilities of banks. Despite the gradual rise in interest rates during this period in global financial markets, their level of allowed domestic banks to continue the policy on external borrowing. [9]

Liabilities to non-residents of Kazakhstan amounted to 2.268 trillion tenge, for the year decreased by 11.5%. The share of liabilities to non-residents of Kazakhstan as of 1 January this year amounted to 19.7% of total liabilities (at the beginning of 2011 this figure stood at 23.9%).

Total assets of banks in Kazakhstan as of 1 January 2012 amounted to 12.809 trillion tenge, an increase over 2011 by 6.5%, said the Committee for the Control and Supervision of Financial Market and Financial Institutions of the National Bank of Kazakhstan. On January 1, the total estimated net worth of the banking sector amounted to 1.961 trillion tenge, an increase over the year by 7.8%.

Much of the attracted resources directed at increasing lending to the domestic economy. The total volume of banks' lending to the economy in December 2011 rose by 2.5% to $ 8 781.4 billion (in 2011 - an increase of 15.7% in 2010 - a decline of 0.7% in 2009 - an increase of 2.5%).

The level of credit risk in the banking system remains high. The key to financial stability of the banking system is the quality of its loan portfolio due to the relatively high concentration of borrowers and active participation in real estate and construction sectors. Service quality borrowers and their obligations under the loan agreements are determined by their financial status, depending on the major developments in the economy as a whole. [6, p.56]

Banks, seeking to meet the growing demand for borrowed funds, are beginning to increase its loans, ignoring the risk assessment and not very caring about the quality of loan portfolios. In some cases, banks are lending to offset the high risks due to high interest rates, which often reach 50% per annum or more. As a result, banks' loan portfolios generate solid returns, but with extremely high risk. Then, when the economy moves from the stage of growth into recession, the credit risks begin to be realized. By this time the bad debt is already considerable interest in the assets of banks and many lending institutions are on the verge of default.

The bank market in the country has a high concentration. The lack of applications for licenses for such activities due to the fact that open a new bank in Kazakhstan is quite difficult. This is probably as high demands on the size of the authorized capital of newly established bank, and other organizational difficulties and the relatively low profitability of the banking business. Given that 29 of the 35 banks located in the city of Almaty, apparently, it would make sense to revise the requirements for the opening of banks located in other regions.

Formations the bank sector by the development of 10-15 largest banks are which account for more than 90% of the assets of the banking system. The share of three largest banks in assets over the years has remained at above 60%. Due to the dynamic development at first place 10-15 major banks supported the rapid growth of the banking sector as a whole. [9]

The reporting period this year, this plan also was no exception. Despite the rapid growth of the base of comparison, the total assets of banks in the first nine months grew by 576.4 billion (34.4%) and amounted to 2252.4 billion tenge. Suffice it to recall that the growth in assets for the nine months exceeded the total assets of the banking sector at the end of 2000 (T528 billion). At this rate, the size of banks' assets could soon reach 50% of GDP. This is, of course, still lower than not only developed but also many developing countries. Nevertheless, a steady trend characterizes the growth of the functionality of the banking sector. [11, p.19]

Despite the increased costs to build reserves for possible losses on loans, profitability indicators of the banking sector grew even more. Profits of banks in the first 9 months amounted to 35.0 billion; its growth rate higher developed than the increase in assets. Nevertheless, the profits were not sufficient to maintain an acceptable level of capitalization. Banks have forced to increase the authorized capital, which rose for the first 9 months amounted to 32.6 billion and 133.0 billion tenge. Such high growth rates have observed for the first time the share capital in recent years, and judging by the information in the media, the banks are going to continue placing its shares on the market.

The leaders of the banking market are still three big banks, which account for more than 60% of total assets, loans and deposits of the banking sector. In this case, there is a gradual reduction in the gap in the size of the assets of the two largest banks, which occupy the first two places on this indicator.

A distinctive feature of last two years has been outstripping the growth rate of bank assets, which occupy the next place in the list of the ten largest banks. As a result, the share of three banks in total banking sector assets decreased to 61.4% compared with 63.9% for the same date last year. Nevertheless, the "big three" retains an advantage in building up assets in absolute terms. [4, p.14]

The rate of growth of assets of ten banks, with the exception of Kazkombank and Bank Caspian, formed higher than in the whole banking system. The highest rates in this plan for nine months showed Center Credit Bank and Alliance Bank, which allowed them to occupy a higher place in the list. Even more rapid growth in assets has demonstrated HSBC bank, which is still not among the 10 large banks. However, this list dropped two other subsidiary banks - ABN AMRO Bank and the City, until recently among the top ten in terms of assets.

As a result, the current dynamics significantly reduced the gap for assets of the banks holding the 3rd and 4th line of the table. Now the assets of the People's Bank more than a bank Center Credit, approximately 2.4-fold, whereas a year ago this figure between the banks, the then 3rd and 4th in the table, was higher by almost 3.2 times. The share of three largest banks in total banking sector assets decreased, but the share of the ten largest banks (with the exception of the Development Bank) in assets is still high and amounts to almost 90%. Thus, one can hardly speak of the declining concentration of financial institutions in terms of assets and the degree of monopolization the bank market. [5, p.29]

Financial performance of major banks listed in the table, compiled according to their balance sheets and reports. Traditionally, the highest profits in absolute terms, shows the top three banks. However, if the judge in terms of return on assets (ratio of profit to total assets), for some incorrectness of the indicator relative to banks with high growth rates of assets, the picture looks somewhat different.

Undisputed leaders in terms of return to assets for the nine months were Caspian Bank and People's Bank, whose profits over the same period last year increased more than twofold. If the first is due in part to slower growth in assets, in respect of the People's Bank should note the observed trend for the second year in a row marked improvement in profitability. Higher than in the banking system, the rate of return has two banks - Bank of the Eurasian and ATF Bank. The other banks represented in the table, the rate of return is somewhat lower than in the whole banking sector.

The fact is a significant change in the structure of the portfolio in the direction of increasing the share of loans for construction, consumer and mortgage lending started happening only recently. This means that the newly issued loans they could not have a significant impact on the deterioration in loan quality. However, judging from the reasons for deterioration in the quality of loans is difficult, and the bankers themselves prefer not to talk about it. Against the backdrop of excess liquidity until the problem could ignore, but in the opinion of international organizations, credit risk remains the weakest point of the Kazakhstan bank sector. [6, p.35]

This may be due to several reasons. First, the standard error of the estimate may slightly distort the measured data. Second, the length of the study data is not sufficiently high, so the specific properties of one category or another could not occur in the period under review. A distinctive feature of last two years has been outstripping the growth rate of bank assets, which occupy the next place in the list of ten largest banks. As a result, the share of three banks in total banking sector assets decreased to 61.4% compared with 63.9% for the same date last year. Nevertheless, the "big three" retains an advantage in building up assets in absolute terms.

Table 1- Markov’s chain the credit portfolio in 01.01.2011

| Categories | Standards | Doubtful 1 | Doubtful 2 | Doubtful 3 | Doubtful 4 | Doubtful 5 | Bad |

| Standards | 90,52 | 8,34 | 0,00 | 35,74 | 36,25 | 87,05 | 0,00 |

| Doubtful 1 | 4,88 | 88,41 | 28,45 | 0,00 | 0,00 | 0,00 | 0,00 |

| Doubtful 2 | 1,34 | 0,00 | 18,69 | 11,07 | 46,75 | 0,00 | 0,00 |

| Doubtful 3 | 0,01 | 2,17 | 34,60 | 42,52 | 0,00 | 0,00 | 33,63 |

| Doubtful 4 | 0,63 | 0,00 | 11,78 | 10,67 | 16,15 | 0,00 | 0,00 |

| Doubtful 5 | 1,97 | 0,00 | 0,00 | 0,00 | 0,85 | 12,95 | 0,00 |

| Bad | 0,65 | 1,08 | 6,48 | 0,00 | 0,00 | 0,00 | 66,37 |

| Note: Compiled by the author according to data of web site http://www.afn.kz/attachments/105/269 | |||||||

Threat to financial stability in the world is a situation in which the volume of nonperforming loans reached 10% of the loan portfolio. The share of loans is in the credit portfolio of the banking system below the critical level of 10%. In turn, the share of overdue customers on loans in the loan portfolio of banks since the beginning of the year fell from 1.3% to 1.0%. To analyze the credit portfolio in this case it is convenient to consider the dynamics of the loans through its representation as a Markov chain. This representation is with acceptable accuracy will determine the matrix of transition probabilities of one category of loans to another and determine the steady state vector of the system. Indicators estimated the matrix of probabilities (in %) of monthly credit migration is presented in Table 1. [10, p.17; 11, p.24]

An assessment shows that the quality of loan portfolio remains relatively good. The stability of the standard categories exceeded 90%, which is a good indicator of the stability of the standard categories with a sharp decrease the transition probability in category toward the categories with the worst credit quality. However, analysis shows that the classification of categories of credit risk does not meet the level of credit risk loans-to-one categories. Theoretically, for example, you can expect an increase in the probability of transition categories with lower credit quality to an even lower. Moreover, the lower is the category; the more likely that this category of loans eventually will be insolvent (goes into the category of non-performing loans). This may be due to several reasons. First, the standard error of the estimate may slightly distort the measured data. Second, the length of the study data is not sufficiently high, so the specific properties of one category or another could not occur in the period under review. Finally, the classification of loans in some categories may not be more than a demonstration of the nominal risk of insolvency of the borrower. The low stability of the "bad loans" also raises doubts about the assignment to her highest degree of credit risk, because, theoretically, this category should be almost closed stochastic (i.e., the probability of migration from this category should be close to zero).

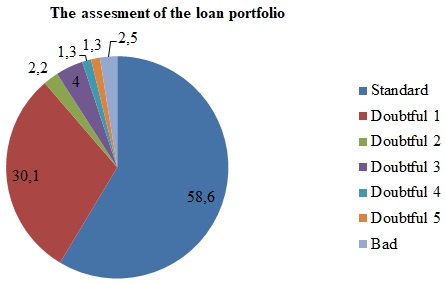

Fig. 2 - The results of assessment of loan portfolio at 01/01/2012*

Note: The diagram created by author and shows average results of the condition loan portfolio. Годовой отчет за 2011 год// Журнал Банки Казахстана N 2, 2012г. с 17

As a result, estimate the long-term assessment of the loan portfolio, which is as follows: Standard - 58.60; Doubtful 1 - 30.10; Doubtful 2 - 2.20; Doubtful 3 - 4.00; Doubtful 4 - 1.30 Doubtful 5- 1.30 Bad - 2.50. [12, p.24]

Reported asset quality indicators Kazakh banks do not fully reflect the risks associated with them are still young and rapidly accrued loan portfolios, which are not checked for a full economic cycle. For the high credit growth in recent years, there was no noticeable accumulation of problem loans.

Most of the loans were not sufficiently "mature". In the growing market for credit commitments, even the problem could be easily refinanced. In addition, due to peculiarities of the Kazakhstan economy bank credit portfolios are generally characterized by a high concentration in certain sectors and regions of loans, making credit risk is even more increased.

In recent years, Kazakhstan has had no major bankruptcies; we can only note the failure of several small construction companies and two banks of medium size. However, potential problems are underestimated due to a lack of clear classification of problem loans. Further lowering of the tenge exchange rate may adversely affect the ability of borrowers to repay their debts.

Meanwhile, at the end of 2010 59% of all loans issued in the Kazakh banking system, has been nominated in foreign currencies. Growth rates of loans create additional pressure on borrowers and increase the likelihood of deterioration in asset quality. Steady inflow of funds due to favorable market conditions in the markets of raw materials (especially oil and gas) and rapidly rising consumption of households is only slightly mitigates the severity of these problems.

In general, the corporate sector a favorable pricing environment of internal and external market determines the persistence of high levels of return on equity (ROE) - 44,6% based on 1 half of 2011, and Assets (ROA) - 15,8% due to increase in return on sales. A limitation of the further growth of profitability of the enterprises is low efficiency, which is reflected in the declining trend in preserving the asset turnover and inventory. [11, p.17]

High levels of profitability sufficient to provide the corporate sector of the working capital reserve, which is reflected in the high level of self-financing (the use of capital to fund assets), and moderate debt burden (the ratio of liabilities to capital in 2010 - 1st half of 2011 at an average of 1.8). However, the situation is uneven across sectors.

The favorable situation in terms of risks to financial stability is ensured, above all, mining and manufacturing industry, transport and communications sector, which accounted for 45% of assets. In the construction trade and has a high level of debt in the face of strong bank lending to these sectors, lower asset turnover and profitability of sales, which could lead to further reduction in profitability. Sector, have significantly improved profitability, is agriculture, primarily due to growth in return on sales.

Unevenly distributed is the situation between large, medium-sized, and small enterprises. In particular, after a period of significant increase in profitability in 2009-2010 on the results of a semester of 2011 there is some stabilization of the profitability of capital and assets.

The risk management system – is a process that includes four main elements: risk assessment, risk measurement, risk control and monitoring of risk. To identify the borrower's credit risk is necessary to collect information about the company in terms of ownership structure, management quality, competitiveness, profitability and stability of production, the influence of industry, market, geographic and other risk factors, availability of the risks associated with collateral (liquidity, adequacy, safety) and other software. Risk identification is carried out during the preparation of loan officers branches (Corporate Finance specialists - at the request of corporate clients), legal and security services branches and Head Office of expert advice on projects, in accordance with the model structures of expert opinions, depending on the categories of borrowers, the industry ware and analysis purposes.

Assessment of credit risk given the borrower is held in preparation for expert advice on risk assessment (in accordance with the approved model structures), the results of an identification of credit risks.

The main methods of managing the direct credit risk are the structuring of transactions and the conditions of funding, establishing a limit to one borrower, ensuring commitments, insurance risk of the borrower; syndication, with the exception of conflict of interest.

Credit plays a specific role in the economy: it not only ensures the continuity of production, but also accelerates it. The basic elements of crediting system are interrelated conditions of the credit transaction. The success of the bank credit only comes in when one of them complement each other, increases the reliability of the credit transaction. Credit is a financial category has its own specific function, accumulation of temporarily free funds, redistributive function and the substitution of non-cash money in cash money circulation.

The credit portfolio is a credit balance of the debt on the balance sheet of a commercial bank on a certain date. One of these criteria, applied to foreign and domestic practice, is the degree of credit risk. According to this criterion is determined by the quality of its loan portfolio. Analysis and evaluation of the quality of loan portfolio allows the managers of the bank to manage its loan operations, and accordingly, to control credit risks.

Management of banks' credit operations is essentially a risk management portfolio with the bank with a set of assets that provide income to the bank from its activities. The bulk of the bank loan portfolio consists of businesses and individuals and hence the risk related to these operations, is of particular importance to the bank. Application of the scoring evaluation of the creditworthiness of a client gives the bank an effective tool for demand management and supply of consumer credit.

Thus, an effective system of scoring can significantly reduce costs and loan losses, thereby strengthening the competitive position of the bank, but ineffective - can lead to serious losses (if very lucky), then only to the lost profits. Therefore the system of credit scoring should be based on the most effective and proven techniques of data analysis and its development should be dealt with by professionals.

References

- Постановление Правления Агентства Республики Казахстан по регулированию и надзору финансового рынка и финансовых организаций от 28 ноября 2008 года № 200 "Об утверждении Правил применения мер раннего реагирования и методики определения факторов, влияющих на ухудшение финансового положения банка второго уровня”

- Постановление Правления Агентства Республики Казахстан по регулированию и надзору финансового рынка и финансовых организаций от 30 сентября 2005 года № 359 “ Об утверждении Инструкции о требованиях к наличию систем управления рисками и внутреннего контроля в банках второго уровня”

- Абишев А.А. , Святов С.А. Настольная книга Банкира/ Экономика, Алматы 2007 г. с 87

- Братко А.Г. Банковский кредит и концепция кредитных бюро/А.Г.Братко// Бизнес и банки.-2007.-N219.

- Корпоративное банковское дело: управление корпоративным кредитным риском/Программа EC TACIS. Банковская академия,- Франкфурт, 2007.

- Тони Райс, Брайн Койли. Финансовые инвестиции и риск. М.: Инфра- М, 2007.

- Закон Республики Казахстан от 30.03.1995 N 2155 "О Национальном Банке Республики Казахстан"

- Закон Республики Казахстан от 31.08.1995 N 2444 "О банках и банковской деятельности в Республике Казахстан"

- Положение Национального Банка от 24.06.1996 N 147 "О классификации ссудного портфеля, порядка формирования и использования резервов по кредитам НБРК "

- Годовой отчет за 2010 год// Журнал Банки Казахстана N 9, 2011г. с 34

- Годовой отчет за 2011 год// Журнал Банки Казахстана N 2, 2012г. с 17

- Годовой отчет за 2012 год// Журнал Банки Казахстана N 5, 2013 г. с 29