VERTICAL INTEGRATION IN AGRIBUSINESS AS A WICKED PROBLEM

Ворожейкина Т.М.

Доктор экономических наук, Финансовый университет при Правительстве Российской Федерации

ВЕРТИКАЛЬНАЯ ИНТЕГРАЦИЯ В АГРОБИЗНЕСЕ КАК НЕРАЗРЕШИМАЯ ПРОБЛЕМА

Аннотация

Целью статьи является обоснование решения по вертикальной интеграции для сельскохозяйственных организаций и их первого покупателя. Выявлено, что специфичность активов в сельском хозяйстве обусловлен степенью использования земли сельскохозяйственными организациями. Была проведена классификация сельскохозяйственных организация по этому признаку на «промышленные», которые используют землю как пространственный базис и «традиционные», которые используют землю как средство производства. Выявлено, что вертикальная интеграция последних приводит к «сцепленной диверсификации», которая проявляется в необходимости производить дополнительные продукты на земле, и является проявлением специфичности активов в сельском хозяйстве.

Ключевые слова: вертикальная интеграция, прямая интеграция, обратная интеграция, сцепленная диверсификация, агробизнес.

Vorozheykina T.M.

Doctor of Economics, The Financial University under the Government of the Russian Federation

VERTICAL INTEGRATION IN AGRIBUSINESS AS A WICKED PROBLEM

Abstract

This paper covers the study of approaches to substantiation upstream and downstream integration on the stage farm unit - the first tier consumer of agricultural products. The effect of the asset specificity in agriculture studied that is shown in the degree of land use on decision making. The farms classified as “industrial” farms that use land as a location and can use purchase products produced on a land, for example, purchase of feed for poultry. And the “traditional” farms that use the land as a means of production and their integration leads to chained diversification. Chained diversification implies required production of additional products, as an asset specificity of the land. It is reflected, for example, in feed production (for cattle) or in production of additional crop due to the necessity of crops rotations. In case of downstream integration of the farm, the possibilities of effective entering into industry of the next stage the supply chain considered, according to the structure of the industry. It was considered that the structure of the industry, the level of its concentration linked to the supply chain length and the depth of agricultural products processing. The reason for it is an existence of specific assets that are entry barriers into the industry. Therefore, the entry in the consolidated industry in a case of a long supply chain is possible only for specific products. Downstream integration of the farm and the next unit of short supply chain are possible for the traditional product. Wicked problem of vertical integration is significantly higher risks of decrease business performance in the future operation of integrated structure. This is true also in integrated structure balance of capacity and at its imbalance due to the reduction of impact on the business competitive environment.

Key words: vertical integration, upstream integration, downstream integration, chained diversification, agribusiness.

- INTRODUCTION

Vertical integration is combining several units of the supply chain within a company. It means that the company does not utilize market transaction for operations. Strategic benefits, cost vertical integration, strategic issues in upstream and downstream integration is discussed by many authors [3].

The development of Russian agribusiness reflects the world trend: rising vertical integration of companies. The problem of vertical coordination in agribusiness and food industries originates from the large number of suppliers of raw material, the length of distribution channels, perishables products and the increasing specificities of consumers. The making decision for vertical integration depends on many factors and can be studied by different approaches.

The decision about the government framework is making according to the Transaction Cost Theory [7], Theory of Supply Chain Management [4,5], the Network Theory [6], the Strategic Management [4,5] etc. All the mentioned theories relate to industries, but not to the agriculture. However, Russian agricultural enterprises are large-scale units; for example, in the Moscow region an average agricultural enterprise of milk-vegetable specialization occupies 3000-3500 ha of land and keeps 1000-1500 heads of cattle. In this conditions additional research of vertical integration of farms and next unit supply chain are required. The quite similar situation occurs in the number of other socialist and post-socialist economies e.g. in China [9] and Hungary [1].

- A CONCEPTUAL FRAMEWORK FOR AGRICULTURAL ENTERPRISES

In Transaction Cost Theory, transaction costs are related to three major characteristics of transactions: frequency of transactions, uncertainty in the transaction and asset specificity of the transactions. But the explanatory power of TCT turns on the degree to which transactions are supported by transaction specific assets [8].

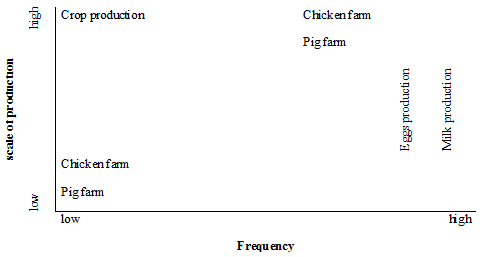

The problem of agribusiness vertical integration was discussed many times. The general view of this problem consists of the following. The high specificity of the assets of both partners is to encourage internal coordination, however, if the uncertainty of the conditions of supply is low, both partners may prefer to contract as a long-base coordination. This situation can be expected in the oligopoly market, where high dependence on the critical and transition costs. Vertical integration may be beneficial to prevent any opportunistic actions of market participants. If uncertainty is high and the asset specificity is low, then the solution of the mechanism of interaction is determined by the frequency of transactions, firms may choose to contractual coordination at a high frequency of transactions, or to choose the spot market at a low frequency. Both companies will be able to find a better partner for justifiable prices. In a mixed situation where the partners have the unsystematic relationship with high asset specificity determinant is an imbalance of capacities.

Thus, if asset specificity is high for one and low for another partner and the uncertainty is low, then the opportunistic approach can be expected from a strong partner. If there is a certain balance of power between the partners, they may choose to integrate, based on contractual arrangements. However, if high asset specificity for one and low to another partner, and in case of high uncertainty they can prefer vertical integration. In capacity imbalance between the partners, the partner with less power may not want to take the risk of possible losses in the contractual arrangements, while the more powerful partner can find a valid contractual agreement. In this situation, it could be recommended for partners to choose a contractual coordination or vertical integration.

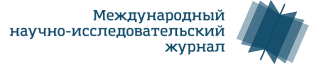

There are the essential differences between agricultural and industrial production frequency of transactions and it depends on: firstly, from branch of an agricultural production, secondly, from its scale. It is clear, that for the majority of branches crop production (exception - horticulture) it is typical to yield once a year. And then frequency of transactions depends on many factors, but, first of all, who is owner of warehouse, storehouses, etc. So, if the farm has, for example, a vegetable storehouse than the frequency of deliveries can be high. If the farm has no storage capacity, delivery can take place only once a year. For deliveries of animal husbandry products the frequency of deliveries is higher. But, simultaneously, in some cases it depends also on scale of production. For example, if the scale of production does not influence on frequency of milk deliveries, pig’s deliveries do depend on scale of production anyway. Dependence of frequency of agricultural products deliveries on branch and scale of production is shown on fig. 1.

It was studied uncertainty considering the following:

Firstly, demand for the most food is not elastic. And in case of incomes of the population are changed, there will be only a transfer of demand qualitative characteristics (except catastrophic events such as war, etc.).

Secondly, quality of food mainly depend on technology of an agricultural production, and then on technology of processing.

Fig.1 - Dependence of frequency of agricultural products deliveries on branch and scale of production

Based on these two points, it is possible to conclude that the higher uncertainty of food demand, first of all concerning qualitative characteristics. The research of framework supply chain choice is also savor for the processing companies. Processing companies are not always pay attention to high cost of transaction specific assets if it concerns to the agricultural enterprises. For example, in 2000-2001 company “Wimm-Bill-Dann” the leader in the Russian milk market has invested in an agricultural production about 10 million US dollars on the following directions: purchase of milking equipment, purchase of breeding animals, purchase modern harvesting techniques and forages. Even so the company has made only leasing contracts. At that moment processing company had strategy of development such as expansion to Russian regions through purchasing of the processing industry companies and/or the expansion into distribution networks. Some Russian meat processing companies are owners of the agricultural enterprises. But they are large (e.g. at least 1 million poultry head or 54 thousands of pigs) farms.

To choose the supply chain design it is necessary to consider all factors: environmental business conditions, supply chain aims, market conditions and leaders (the direction of integration). In case of the downstream integration, the agricultural enterprises make a decision to expand to the next stage on the basis of Transaction Cost Theory. There are some examples of the successful downstream integration in milk and poultry chains in Russia.

In case of upstream integration it is necessary to take into account the results of the vertical integration. There can be found two main cases. First is the inhomogeneity of agricultural enterprises in terms of their "chained" to the land. There are industrial farms that use the land only as a location of production, such as poultry, pig farms, greenhouse. And there are the traditional agricultural enterprises, in which land is used as a means of production, for example, companies which produce crops and livestock. In case of downstream integration, for agricultural enterprise, the decision to buy the next stage of production (processing) on decision making will affect the scale of production, the balance of scale and the situation on the market, whether industrial or traditional agricultural enterprise. Obviously, for decision on vertical integration will be "pull" and dynamic market, the balance of scale and the large scale of production. In the case of "push" market in region, the solution of the downstream integration would make sense only if it will assist in sales the products on the market.

Fig. 2 - Dependence of framework on land use method and frequency

For upstream integration, when, for example, proceeding company would like to buy a farm, it is necessary to understand long-term consequences of this decision. In the case of purchase of industrial agricultural enterprise requires vertical integration, allowing, for example, meat-processing plant to solve the problem of raw materials. Although the effectiveness of the solution is not as straightforward as in other cases considered earlier. When it relate to purchasing a traditional agricultural enterprise, its implementation will lead not only to vertical integration, but also to chained diversification. The chained diversification is inevitably arises diversification in a case of purchasing a traditional agricultural enterprise due to technological peculiarities of agricultural production and its biological nature. And it is practically impossible to decrease the level of chained diversification. Actually, it is unreal now to produce only milk (without beef/veal and feed production) or to produce sunflower seed without crop rotation. And it will be better to use another government structures for “traditional” agricultural enterprises.

If frequency is low, traditional farms may opt the spot market, while industrial farms may opt for contractual coordination. If frequency is high, traditional farms may opt for contractual coordination and industrial farms for vertical integration.

- DISCUSSION

Results of this paper are the basis for further study of government framework for farm unit - first-tier customers of supply chain. The proposed perspective framework approach helps to analyze the upstream integration of farm.

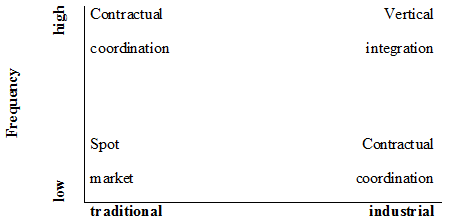

It was considered that the possibility of direct integration of the farm unit and consumer unit the of the supply chain. Also the structure of the industry in which operates the consumer unit take into account. The more consolidated industry of consumer unit, the more specific products of integrated structure needs to be.

The consolidated industries in downstream agri and food supply chain are characteristic of long chains. Conversely, the shorter the supply chain, the lower consolidated industry is following the farm unit. It is a reflection of low overall entry barriers into the industry, because of asset specificity.

Fig. 3 shows the possibility of downstream integration of the farm unit and the consumer unit and product specificity.

Fig. 3 - Matrics of farm downstream integration

Downstream integration into a fragmented industry with a short and long distribution channel will have a positive effect for both traditional and special products. In all other cases, the downstream integration will be possible if the integration will lead to product differentiation.

The further development of an integrated structure consisting of farm unit and the next stage of the supply chain can lead to potential risks as at the balance of capacity, and in an imbalance.

Under maintaining balance of integrated company potential risks describes M. Porter [3]. Using integrated company the transfer prices and they diverge from market price, one unit will be subsidising the other compared to what it could achieve on the open market.

Downstream unit imbalance leads to potential risks of integrated company arise from supply other organization, perhaps with slightly different requirement [2]. And it will not be feasible and desirable of owned supplier.

Under upstream unit imbalance results in a number of consumer of farm unit. And in this case owned consumer unit will not be preferable to price or delivery requirements.

References

- Cungu, A., Hamish, G., Swinnen, J. F. M. and Vranken, L. Investment with weak contract enforcement: evidence from Hungary during transition //European Review of Agricultural Economics. - Vol 35 (1). -2008. - pp. 75–91

- Hayers, R.H. and Wheelwright, S.C. Restoring our Competitive Edge, John Wiley, 1984

- Osipov V.S. The wheel of coompetition as a new instrument of strategic management // World Applied Sciences Journal. 2013. Т. 27. № 8. С. 1083-1086.

- Porter, M. E. Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York.: Free Press, 1985.

- Porter, M. E., Strategy and Internet, Harvard Business Review, Vol. 79 March, pp. 62-78, 2001.

- Uzzi, B. Social Structure and Competition in Interfirm Networks: the Paradox of Embedded ness, Administrative Science Quarterly, Vol. 42 pp. 35-67, 1997.

- Williamson, O.E. Economic Institutions of Capitalism: Firms, Markets, Relational Contracting. Free Press, New York, 1985.

- Williamson, O.E. Strategy Research: Governance and Competence Perspectives, Strategic Management Journal, Vol. 20, pp. 1087-1108, 1999.

- Zhang, Q. F. The Political Economy of Contract Farming in China’s Agrarian Transition // Journal of Agrarian Change/ - Vol. 12 No. 4/ - October 2012. -pp. 460–483.